In the fast-evolving landscape of the healthcare industry, the role of the chief financial officer has transformed dramatically. Today's CFOs are not just numbers experts; they are strategic leaders who play a key role in navigating complex financial landscapes, especially during acquisitions and integrations. As healthcare organizations continue to grow through mergers and partnerships, the need for strong financial leadership becomes paramount. This article delves into effective strategies for success in healthcare acquisitions and beyond, drawing on insights from professionals who have successfully steered their organizations through challenges and opportunities alike.

With an MBA from the Kelley School of Business at Indiana University and experience in top-tier firms like KPMG, CFOs bring a wealth of knowledge in financial management, risk management, and business development. Effective leadership in this sector hinges on a deep understanding of both the healthcare environment and financial operations. By embracing principles of relationship building, trust, and mutual respect, financial leaders can foster productive teams that enhance operational efficiency and drive successful acquisition integration. In this exploration, we will examine the success principles that empower CFOs to manage debt effectively, improve productivity, and ultimately contribute to advancements in critical areas like biotechnology and cancer treatment.

The Role of the CFO in Healthcare Acquisitions

Learn More from Jeffrey Hammel

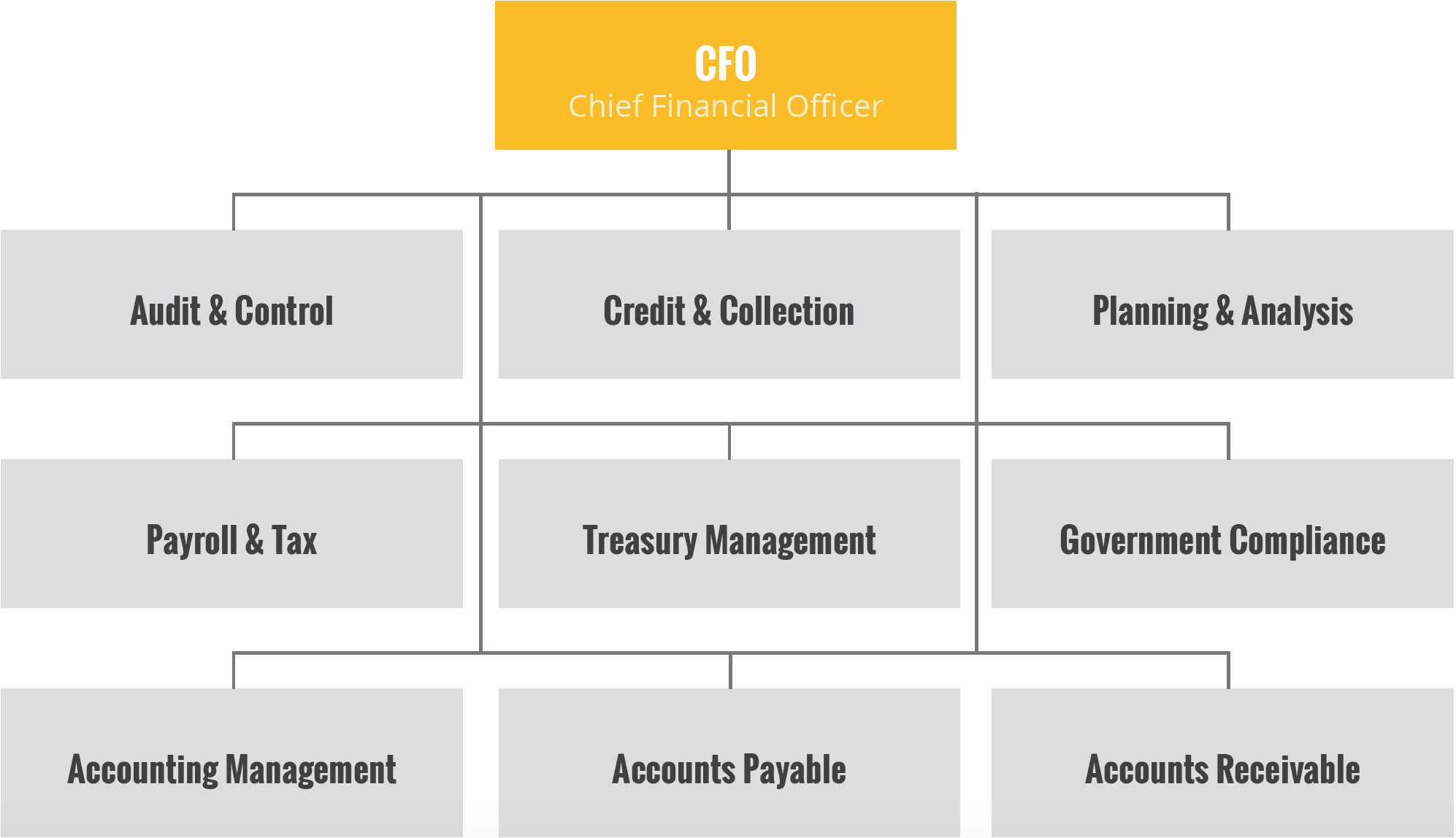

The Chief Financial Officer plays a pivotal role in healthcare acquisitions, acting as a strategic partner to guide the organization through complex financial landscapes. With expertise in finance and business planning, the CFO is responsible for analyzing potential acquisition targets, assessing their financial health, and identifying alignment with the healthcare organization's mission. This requires a deep understanding of risk management principles to evaluate potential liabilities and ensure that the acquisition contributes to long-term organizational goals.

During the acquisition integration phase, the CFO's leadership is crucial in ensuring smooth transitions and operational efficiency. They oversee financial operations, ensuring that both companies' financial systems align seamlessly. This involves collaboration with various departments to foster a cohesive strategy, maintaining fiscal discipline while promoting practices that enhance productivity and cost reduction. Building strong relationships with stakeholders, including the board of directors, is vital for establishing mutual respect and trust throughout the process.

Furthermore, the CFO is instrumental in securing funding for acquisitions, particularly in a sector where private funding and investments are key to driving growth. They leverage their connections from previous roles at companies such as Eli Lilly & Company and KPMG to attract investors and align financial resources effectively. A successful CFO in healthcare acquisitions not only focuses on immediate financial outcomes but also on long-term growth and sustainability, embodying the success principles that lead to enduring organizational success.

Key Strategies for Effective Risk Management

In the healthcare industry, effective risk management is crucial for safeguarding assets and ensuring regulatory compliance. Chief financial officers must adopt a proactive approach by identifying potential risks associated with acquisitions and operational changes. Conducting thorough due diligence during the acquisition integration process can unearth hidden financial liabilities and operational inefficiencies. This foundational strategy enables CFOs to design comprehensive risk mitigation plans that align with overall business objectives.

Another key strategy involves fostering a culture of transparency and open communication within the organization. By building strong relationships at all levels, from the board of directors to frontline employees, financial leaders create an environment where risks can be discussed openly without fear. This mutual respect enhances collaboration across departments, allowing for shared insights that lead to more informed risk assessments. Regular training and workshops can also keep the team updated on the latest risk management practices and regulatory requirements, further strengthening the organization’s defensive posture.

Finally, leveraging data analytics tools can significantly improve risk management efficiency. CFOs should invest in technology that enhances the monitoring of financial performance and operational effectiveness. By utilizing predictive analytics, healthcare organizations can anticipate potential challenges before they become critical, enabling timely interventions. This focus on operational efficiency not only aids in risk management but also aligns with broader goals such as productivity improvement and cost reduction, creating a resilient financial framework for sustained success.

Integration Challenges in Business Acquisitions

Integrating new acquisitions within the healthcare sector presents unique challenges that require a strategic approach. As a chief financial officer, understanding the intricacies of both financial and operational integration is essential. One major hurdle involves aligning different corporate cultures, which can lead to resistance among employees and disruptions in workflow. Building mutual respect and fostering strong relationships during this transition can significantly impact overall integration success. The emphasis on communication and transparency is critical to alleviate concerns and promote collaboration among diverse teams.

Another significant challenge in acquisition integration is the alignment of financial systems and processes. Different companies often operate on varied platforms and methodologies, which can complicate efforts to achieve operational efficiency. A CFO must ensure that financial management practices are harmonized to maintain accurate reporting and effective cost reduction strategies. This includes reevaluating previous financial commitments and debt management strategies to support seamless integration. Successful integration will depend on the deft navigation of these systems to minimize disruptions and ensure that both entities benefit from the merger.

Lastly, leaders in healthcare acquisitions must confront compliance and regulatory challenges specific to the industry. Navigating the complex landscape of healthcare regulations demands vigilance and a proactive approach to risk management. A CFO must coordinate strategies that ensure all aspects of the acquisition meet legal and regulatory requirements. This involves working closely with the board of directors and external auditors to maintain transparent financial records and uphold the highest standards of corporate governance. Ultimately, overcoming these integration challenges is vital to realizing the intended synergies and driving long-term growth in a competitive landscape.

The Importance of Financial Management in Healthcare

Effective financial management is crucial in the healthcare sector, as it directly impacts the quality of care provided and the overall sustainability of healthcare organizations. A robust financial strategy enables healthcare leaders, including chief financial officers, to align resources efficiently while navigating complex regulatory environments. By prioritizing financial discipline, organizations can ensure they meet the necessary operational costs while investing in new technologies and treatments, ultimately enhancing patient outcomes.

Risk management is another vital aspect of financial management that helps healthcare organizations mitigate uncertainties surrounding acquisitions and integration processes. As the industry faces increasing pressures from private funding sources and fluctuating reimbursements, CFOs must leverage their expertise in finance and business planning to develop strategies that minimize risk while maximizing the potential for growth. By implementing sound financial practices, organizations can secure their future and foster trust among stakeholders, including clients, board members, and investors.

Additionally, strong financial management promotes operational efficiency and supports productivity improvements within healthcare organizations. By optimizing resource allocation and focusing on cost reduction initiatives, CFOs can enhance the organization's capacity to deliver high-quality services. Through effective relationship building and a culture of mutual respect, financial leaders can inspire their teams to embrace transparency and accountability, leading to better financial outcomes and improved patient care.

Building Relationships for Successful Leadership

Learn More from Jeffrey Hammel

In the healthcare industry, effective leadership is built on strong relationships. A chief financial officer must cultivate trust not only within their finance team but also across various departments, including operations and clinical leadership. Building these relationships begins with open communication, ensuring that all stakeholders feel heard and valued. By creating a culture of mutual respect, a CFO can foster an environment where ideas and concerns are freely shared, leading to better decision-making and enhanced collaboration during critical processes such as acquisition integration and business planning.

Moreover, a successful CFO must actively engage with the board of directors and key external partners, including private funding sources and other healthcare organizations. These relationships are pivotal for aligning financial strategies with broader organizational goals. By investing time in relationship building, the CFO can establish credibility and demonstrate their commitment to the organization's mission. This connectivity not only aids in navigating complex financial landscapes but also enhances the CFO's capacity to advocate for necessary investments in areas like biotechnology and cancer treatment initiatives.

Team building is another essential facet of effective leadership in finance. A CFO should prioritize the development of strong teams that operate with a shared vision and purpose. By emphasizing respect and trust within the finance operations team, a CFO can drive productivity improvement and cost reduction efforts. Through mentorship and supportive leadership, the CFO can empower team members to take ownership of their roles, which in turn leads to improved operational efficiency and more effective risk management as the organization navigates the intricacies of financial management in healthcare.

Cost Reduction and Productivity Improvement Techniques

In the healthcare sector, cost reduction and productivity improvement are critical for financial sustainability and operational efficiency. Chief Financial Officers must analyze existing processes and identify areas of waste. Implementing lean practices can streamline operations, reduce overhead costs, and enhance productivity. Utilizing technology such as electronic health records and automated billing systems not only minimizes human errors but also accelerates workflow, allowing staff to focus on patient care rather than administrative tasks.

Effective training and development programs play a significant role in improving productivity. Investing in employee skillsets fosters an environment of continuous improvement. When staff are equipped with the knowledge to deliver high-quality care efficiently, it leads to better resource utilization and can significantly reduce costs associated with turnover and retraining. Emphasizing a culture of teamwork and mutual respect can further enhance collaboration among departments, driving productivity improvements across the organization.

Another important strategy involves scrutinizing supplier contracts and negotiating terms that benefit both parties. Long-term partnerships with key suppliers can lead to favorable pricing and improved service delivery. In addition, adopting a data-driven approach to financial management enables CFOs to make informed decisions that align with the organization’s strategic goals. By leveraging analytics, healthcare leaders can identify trends and forecast financial needs, ultimately facilitating better cost management and productivity enhancements.

Fostering a Culture of Trust and Team Building

In the dynamic landscape of healthcare acquisitions, fostering a culture of trust is paramount for the success of financial leadership. A chief financial officer must prioritize relationship building, not just among the finance team but across all departments within an organization. By cultivating an environment where open communication is encouraged, teams can share insights and work collaboratively towards common goals. This mutual respect enhances not only team morale but also productivity, as individuals feel valued and invested in the organization's mission.

Effective team building goes beyond just internal dynamics; it extends to relationships with external stakeholders such as the board of directors and investors. Establishing trust within these relationships is crucial for securing private funding and navigating complex acquisition integrations. A CFO's ability to articulate a clear and compelling business strategy can instill confidence, thereby strengthening partnerships that are vital for operational efficiency. By demonstrating respect and reliability, financial leaders can position their organizations as attractive prospects for collaboration and investment.

Learn More from Jeffrey Hammel

Ultimately, a culture rooted in trust and teamwork leads to enhanced financial management and improved outcomes in healthcare settings. The principles of success in finance operations, such as cost reduction and debt management, thrive in environments where team members feel empowered and respected. By committing to these values, CFOs can drive positive change, underpinning strategic initiatives with a united front that focuses on both the organization’s goals and the well-being of its people.